Content

The net value is its original cost depreciated according to a specific rate over the years. The procurement patterns for these assets tend to be quite costly and have high lead times. However, if you manage to keep accurate records for your fixed assets, this helps you in many ways. Another point to clarify here is that fixed assets don’t have to be ‘fixed’.

But it’s important to note that the definition of a fixed asset hinges on its expected lifespan rather than its price. With the exception of land, fixed assets are depreciated to reflect the wear and tear of using the fixed asset.

Fixed Asset Vs Current Asset: What’s The Difference?

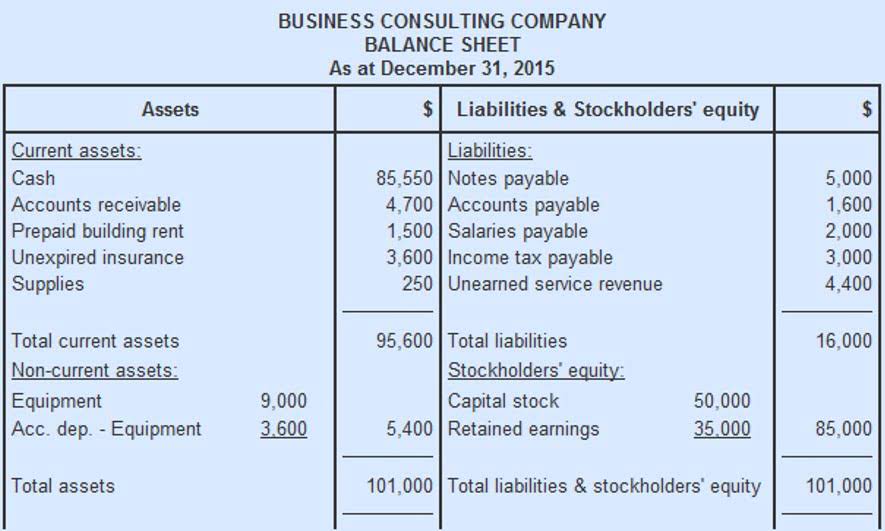

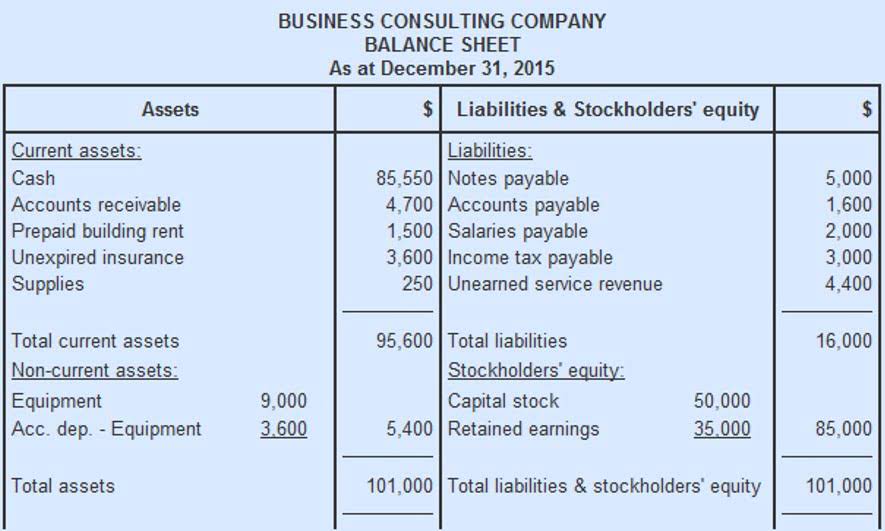

First, it gives a relatively accurate reflection of the asset’s contribution to the business. Even if they don’t, they are likely to be superseded by other options. A cash flow Statement contains information on how much cash a company generated and used during a given period.

A fixed asset appears in the financial records at its net book value, which is its original cost, minus accumulated depreciation, minus any impairment charges. Because of ongoing depreciation, the net book value of an asset is always declining. However, it is possible under international financial reporting standards to revalue a fixed asset, so that its net book value can increase.

Schedules & Forms

Examples of fixed assets are land, buildings, manufacturing equipment, office equipment, furniture, fixtures, and vehicles. Except for land, the fixed assets are depreciated over their useful lives. An example of a company’s fixed asset would be a company that produces and sells toys. The company purchases a new office building for $5 million along with machinery and equipment that costs a total of $500,000.

- Assets that are under renovation or construction are capitalized if the total cost is $100,000 or 20% of the building.

- Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- One caution to keep in mind when using this metric is that accelerated depreciation can drastically skew this ratio and make it somewhat meaningless.

- A higher number of depreciation means that a business hasn’t replaced their fixed assets in a while.

- Current assets include cash and cash equivalents, accounts receivable, inventory, and prepaid expenses.

- Different companies may calculate salvage values differently but it usually depends on the frequency of use, item type, and deprecation rate.

Second, MTC wouldn’t be required to purchase additional assets to service the new territory immediately. Total liabilities are combined debts and all financial obligations payable by a company to individuals as well as other organizations at the precise period. Property Management, upon review , will add the asset to the new fixed asset system.

Join Pro Or Pro Plus And Get Lifetime Access To Our Premium Materials

With customer-centric solutions native to Salesforce, FinancialForce is designed to scale with your business. Amid rapid industry changes, professional services businesses still want to deliver great results on time and on budget, keeping customers happy and successful.

CI Global Asset Management Continues Modernization of Product Lineup – Business Wire

CI Global Asset Management Continues Modernization of Product Lineup.

Posted: Mon, 29 Nov 2021 15:30:00 GMT [source]

For example, a computer server may have a life of five years and no salvage value. Yearly depreciation expense would be the cost of the asset divided by its life time. These issues are part of the day-to-day responsibilities of an asset accountant. The Expenditure Type is the core data element used for Fixed Asset reporting. “Final Inventory Certification” reports, summarizing missing equipment assets, are sent to the org chairs by FAA which require their signatures to finalize the inventorying process.

Should I Include The Maintenance Agreement Cost Part Of The Total Asset Cost?

Its non-current assets would be the oven used to bake bread, motor vehicles used to transport deliveries, and cash registers used to handle cash payments. While these non-current assets have value, they are not directly sold to consumers and cannot be easily converted to cash. Information about a corporation’s assets helps create accurate financial reporting, business valuations, and thorough financial analysis. Investors and creditors use these reports to determine a company’s financial health and decide whether to buy shares in or lend money to the business. The term alludes to the fact that these assets won’t be used up or sold within the accounting period.

Equipment must be maintained in accordance with SCHEV retention guidelines contained in the ETF Retention Schedule. A P-1 form is only required for equipment to be scrapped, cannibalized, or being traded-in, or has been lost or stolen.

Old Dominion University

A higher number of depreciation means that a business hasn’t replaced their fixed assets in a while. An owner could look at this number and decide if they need to replace anything to improve their operations. They provide long-term financial benefits, have a useful life of more than one year, and are classified as property, plant, and equipment (PP&E) on the balance sheet.

Movable assets have an asset purchase cost of $5,000 or greater per unit and depreciate monthly for the life of the asset. Along with this, there is a debit entry to what is a fixed asset in accounting the specific fixed asset account. This cost can also include any other overheads incurred, including freight charges, sales tax, installation charges, and so on.

Form 424B2 BARCLAYS BANK PLC – StreetInsider.com

Form 424B2 BARCLAYS BANK PLC.

Posted: Tue, 30 Nov 2021 16:54:06 GMT [source]

It is not required for equipment being surplused through Facility Management’s Surplus Property process. Equipment assets deemed “missing” for two consecutive inventory cycles will be written-off in the subsequent fiscal year and removed from the Fixed Assets sub-ledger system. Insurance coverage allows you to tackle unexpected damages to your assets without emptying your bank account. In order to control such unfavorable activities, it is critical to tag all assets.

Accounting For Fixed Assets, 2nd Edition

If the original Expenditure Type used is incorrect, a cost transfer correction must be completed via the Grants Accounting Module in the Integrated System. Plant Accounting software began taking digital pictures of capital equipment in 1997. If you would like a picture of an asset, e-mail your request to Plant Accounting. Recording disposal is as important as entering data about a new purchase. The type of machinery a company uses depends on its particular industry. For example, a construction firm most likely has numerous trailers and cranes. Furthermore, tools and instruments facilitate technical work and help achieve operational efficiency.

We and our advertising partners use electronic technologies to collect certain types of personal information through our digital properties in order to provide you with relevant advertisements. Personal information may include your IP address, digital identifiers, and your interactions with digital properties. Multiple platforms and programs create workflow disruptions and needlessly complex processes. Augment your asset maintenance program with AI, powered by IBM Watson technology for continuous learning.

Success in maintaining reliable accounting reports can help firms exercise robust preventative maintenance, improve productivity, and deter theft. Most companies fail to come up with the correct depreciation rate for their assets owing to unreliable methods of calculation. If a company continues to apply the incorrect rate, their data will be full of errors. Therefore, all firms need to ensure that they carry out the process with utmost care. A single error in financial reports can lead to grave consequences – potentially damaging company integrity. These can either be movable items, such as desks, or utilities affixed to buildings, such as lights.

The financial statements are key to both financial modeling and accounting. Fixed assets are used by the company to produce goods and services and generate revenue. A fixed asset does not actually have to be “fixed,” in that it cannot be moved. Many fixed assets are portable enough to be routinely shifted within a company’s premises, or entirely off the premises.

What is the journal entry for goodwill?

The goodwill account is debited with the proportionate amount and credited only to the retired/deceased partner’s capital account. Thereafter, in the gaining ratio, the remaining partner’s capital accounts are debited and the goodwill account is credited to write it off.

However, land cannot be depreciated because it cannot be depleted over time unless it is land containing natural resources. Property, plant, and equipment (PP&E) are long-term assets vital to business operations and not easily converted into cash. Asset tracking software and management solutions offer a reliable way to oversee fixed assets. Included are features like location tracking, work order processing and audit trails.

Fixed assets are also known as tangible assets or property, plant, and equipment (PP&E). In terms of accounting, fixed asset accounting term is referred to assets and property which is not easily converted into cash.

Ideally, fixed asset management improves the quality and useful life of equipment and ensures the best return on investment. The most common use of this financial metric is in mergers and acquisitions. When a company is analyzing possible acquisition candidates, they must analyze the assets and put a value on them. Gifts of fixed assets that are not intended to be used in operations are recorded as investments. Movable assets include items that are not necessarily part of the building itself.

If your company assets undergo impairment, then you have to document this change in the financial statements as well. Therefore, the organization is in need to keep the accounts of its fixed assets in order to acquire the accurate balance sheet at the end of the financial year for the enhancement of your business. Second, depreciation allows a business to account for the cost of an item over two or more years. This avoids fluctuations in its financial statements every time a new fixed asset is purchased and thus gives a more realistic view of the business’ overall performance. The accountant should periodically test all major fixed assets for impairment. Impairment is present when an asset’s carrying amount is greater than its undiscounted future cash flows.

Author: Laine Proctor